Bajaj Finserv Limited

NSDC & Ministry of Education partner with Bajaj Finserv for skill development

Bajaj Finserv

4 March, 2024

5 min read

National Skill Development Corporation & Ministry of Education partner with Bajaj Finserv to skill youth for employment in financial sector

- Partnership enables Bajaj Finserv to scale up skilling of young graduates for employment in financial services through its flagship employability program - Certificate Program in Banking, Finance & Insurance (CPBFI)

- Youth skilling under the partnership set to commence in 10 districts of Orissa with students receiving joint certification accredited by Bajaj Finserv and Skills India

Delhi December 12, 2023: The Ministry of Education and National Skill Development Corporation (NSDC), part of the Ministry of Skill Development and Entrepreneurship, which promotes large scale skilling initiatives in the country, today forged a partnership with Bajaj Finserv Ltd., one of India’s leading and most diversified financial services groups, to prepare young graduates for employment opportunities in the financial services sector.

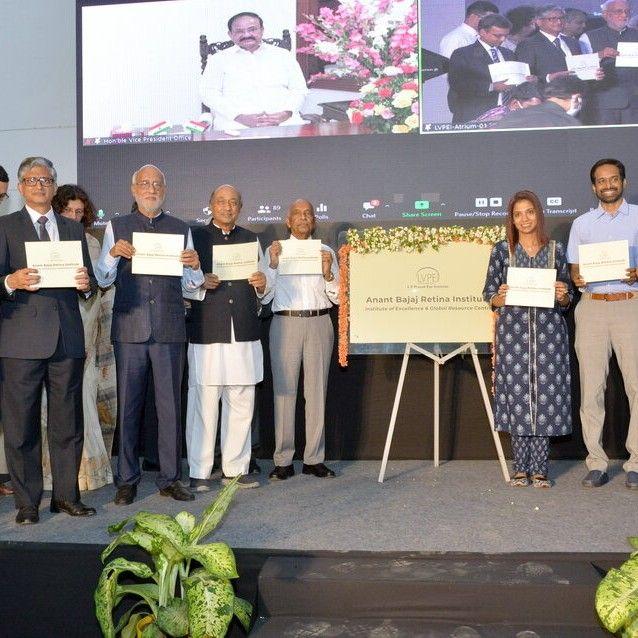

A Memorandum of Understanding (MoU) was signed by NSDC and Bajaj Finserv in the presence of Dharmendra Pradhan, Union Minister for Education and Skill Development & Entrepreneurship, Ved Mani Tiwari, CEO, NSDC and Sanjiv Bajaj, Chairman & MD of Bajaj Finserv. The signing ceremony was also attended by Kurush Irani, President Group - CSR and Pallavi Gandhalikar, National Head – CSR of Bajaj Finserv.

Speaking at the ceremony, Dharmendra Pradhan, Union Minister for Education and Skill Development & Entrepreneurship, said, “Empowering youth with the right skills is not just an investment in a strong future but also a commitment to our nation's economic prosperity. Our partnership with Bajaj Finserv will help create a multiplier effect on youth skilling, as the certification programme will prepare them for employment in the growing and challenging financial services industry. Through this initiative, we look forward to transforming the aspirations of youth into reality and fostering a skilled workforce that supports India’s dynamic growth.”

Ved Mani Tiwari, CEO, NSDC and MD, NSDC International said, “The financial services industry is characterized by a massive increase in demand for skilled workers, At NSDC, our aim is to provide youth with more skilling and upskilling avenues, enabling them to acquire relevant domain knowledge. Our collaboration with Bajaj Finserv is a strategic

step towards aligning our skilling initiatives with the industry's evolving needs and addressing the nation’s skill gap. With this initiative, Bajaj Finserv is significantly expanding the scope of its CPBFI program."

Sanjiv Bajaj, Chairman & Managing Director, Bajaj Finserv Ltd., said, “India is entering an interesting phase of growth, matched by its promising demographics. However, the country faces a shortage of skilled workers, and the private sector has the opportunity to be one of the first responders to the situation. At Bajaj Finserv, we have identified youth skilling as a significant pillar of our social impact programmes. Our partnership with NSDC and the Ministry of Education will help us make a difference to young people by providing them with greater access to skilling which opens infinite possibilities of success. It will also build economic resilience and an inclusive workforce for the future, in line with the theme of Kaushal Bharat, Kushal Bharat.”

Under the partnership, Bajaj Finserv will take forward skilling initiatives through its Certificate Program in Banking, Finance & Insurance (CPBFI), a 100-hour programme developed in collaboration with industry experts, training partners, educational institutions and psychological health institutes.

CPBFI currently runs across 350+ colleges in 23 states, 100 districts and 160+ towns. It is aimed at nurturing skills, knowledge and attitude among graduates and MBA aspirants especially in tier 2 and 3 cities, enabling them to seek employability and take the right decisions related to their long-term careers in the financial services sector.

In addition to imparting domain knowledge, it also enhances confidence through cognitively designed communication and workplace skills. To date, CPBFI has trained and benefited over 40,000 students from tier 2 & tier 3 towns since inception.

The Ministry of Education has recognised Orissa as a priority state. Bajaj Finserv will deepen its collaboration with Orrisa colleges and roll out CPBFI batches over the next few months. The initiative is set to commence in 10 districts of Orissa with students receiving a joint certification accredited by Bajaj Finserv and Skills India on successful completion of the course.

About Bajaj Finserv

Bajaj Finserv Ltd, an unregistered Core Investment Company (CIC) under Core Investment Companies (Reserve Bank) Direction, 2016, as amended, is one of India’s leading promoters of financial services with consolidated total income of Rs. 82,072 crore in FY23. Bajaj Finserv serves over a 100 million customers with its diversified portfolio that helps meet financial needs and build an individual’s financial resilience. Its suite of financial solutions includes savings products, consumer and commercial loans, mortgages, auto financing, securities brokerage services, general and life insurance, and investments. Bajaj Finserv is focused on continuous innovation through smart use of technology, data and analytics to drive seamless, simplified and personalized experiences for its customers. Bajaj Finserv holds 52.49% stake in Bajaj Finance Ltd., a listed non-bank with the strategy and structure of a bank. It holds 74% stake each in Bajaj Allianz General Insurance Company Ltd. and Bajaj Allianz Life Insurance Company Ltd. Subsidiaries of Bajaj Finance Ltd. include Bajaj Housing Finance Ltd., offering a range of housing finance solu-tions, and Bajaj Financial Securities Ltd, an all-in-one digital platform combining demat, broking and margin trade financing for retail and HNI clients on a predominantly B2C platform. Bajaj Finserv holds an 80.13% stake in Bajaj Finserv Direct Limited, a diversified financial services and e-commerce open architecture marketplace for loans, cards, insurance, investments, payments and lifestyle products. Bajaj Finserv’s wholly owned subsidiaries include Bajaj Finserv Health Ltd., Bajaj Finserv Ventures Ltd., Bajaj Finserv Asset Management Ltd., and Bajaj Finserv Mutual Fund Trustee Ltd. Both BFS and BFL are included in the benchmark BSE Sensex and Nifty 50 index of large cap stocks. Bajaj Finserv is committed to driving equitable and inclusive opportunities for children and youth through its social impact initiatives. Its social responsibility pro-grammes in the areas of skilling, health, education, protection, skilling and inclusion for people with disability (PwD) are life-transformative and aimed at solving the most pressing issues of society. So far, Bajaj Finserv and its group of companies have touched over 2 million lives through 200+ partner-implemented programmes across the country. The company runs its flagship employability programme, CPBFI- Certificate Programme in Banking Finance and Insurance, aimed at making graduates from small towns employable in financial services industry.

National Skill Development Corporation & Ministry of Education partner with Bajaj Finserv to skill youth for employment in financial sector

- Partnership enables Bajaj Finserv to scale up skilling of young graduates for employment in financial services through its flagship employability program - Certificate Program in Banking, Finance & Insurance (CPBFI)

- Youth skilling under the partnership set to commence in 10 districts of Orissa with students receiving joint certification accredited by Bajaj Finserv and Skills India

Delhi December 12, 2023: The Ministry of Education and National Skill Development Corporation (NSDC), part of the Ministry of Skill Development and Entrepreneurship, which promotes large scale skilling initiatives in the country, today forged a partnership with Bajaj Finserv Ltd., one of India’s leading and most diversified financial services groups, to prepare young graduates for employment opportunities in the financial services sector.

A Memorandum of Understanding (MoU) was signed by NSDC and Bajaj Finserv in the presence of Dharmendra Pradhan, Union Minister for Education and Skill Development & Entrepreneurship, Ved Mani Tiwari, CEO, NSDC and Sanjiv Bajaj, Chairman & MD of Bajaj Finserv. The signing ceremony was also attended by Kurush Irani, President Group - CSR and Pallavi Gandhalikar, National Head – CSR of Bajaj Finserv.

Speaking at the ceremony, Dharmendra Pradhan, Union Minister for Education and Skill Development & Entrepreneurship, said, “Empowering youth with the right skills is not just an investment in a strong future but also a commitment to our nation's economic prosperity. Our partnership with Bajaj Finserv will help create a multiplier effect on youth skilling, as the certification programme will prepare them for employment in the growing and challenging financial services industry. Through this initiative, we look forward to transforming the aspirations of youth into reality and fostering a skilled workforce that supports India’s dynamic growth.”

Ved Mani Tiwari, CEO, NSDC and MD, NSDC International said, “The financial services industry is characterized by a massive increase in demand for skilled workers, At NSDC, our aim is to provide youth with more skilling and upskilling avenues, enabling them to acquire relevant domain knowledge. Our collaboration with Bajaj Finserv is a strategic

step towards aligning our skilling initiatives with the industry's evolving needs and addressing the nation’s skill gap. With this initiative, Bajaj Finserv is significantly expanding the scope of its CPBFI program."

Sanjiv Bajaj, Chairman & Managing Director, Bajaj Finserv Ltd., said, “India is entering an interesting phase of growth, matched by its promising demographics. However, the country faces a shortage of skilled workers, and the private sector has the opportunity to be one of the first responders to the situation. At Bajaj Finserv, we have identified youth skilling as a significant pillar of our social impact programmes. Our partnership with NSDC and the Ministry of Education will help us make a difference to young people by providing them with greater access to skilling which opens infinite possibilities of success. It will also build economic resilience and an inclusive workforce for the future, in line with the theme of Kaushal Bharat, Kushal Bharat.”

Under the partnership, Bajaj Finserv will take forward skilling initiatives through its Certificate Program in Banking, Finance & Insurance (CPBFI), a 100-hour programme developed in collaboration with industry experts, training partners, educational institutions and psychological health institutes.

CPBFI currently runs across 350+ colleges in 23 states, 100 districts and 160+ towns. It is aimed at nurturing skills, knowledge and attitude among graduates and MBA aspirants especially in tier 2 and 3 cities, enabling them to seek employability and take the right decisions related to their long-term careers in the financial services sector.

In addition to imparting domain knowledge, it also enhances confidence through cognitively designed communication and workplace skills. To date, CPBFI has trained and benefited over 40,000 students from tier 2 & tier 3 towns since inception.

The Ministry of Education has recognised Orissa as a priority state. Bajaj Finserv will deepen its collaboration with Orrisa colleges and roll out CPBFI batches over the next few months. The initiative is set to commence in 10 districts of Orissa with students receiving a joint certification accredited by Bajaj Finserv and Skills India on successful completion of the course.

About Bajaj Finserv

Bajaj Finserv Ltd, an unregistered Core Investment Company (CIC) under Core Investment Companies (Reserve Bank) Direction, 2016, as amended, is one of India’s leading promoters of financial services with consolidated total income of Rs. 82,072 crore in FY23. Bajaj Finserv serves over a 100 million customers with its diversified portfolio that helps meet financial needs and build an individual’s financial resilience. Its suite of financial solutions includes savings products, consumer and commercial loans, mortgages, auto financing, securities brokerage services, general and life insurance, and investments. Bajaj Finserv is focused on continuous innovation through smart use of technology, data and analytics to drive seamless, simplified and personalized experiences for its customers. Bajaj Finserv holds 52.49% stake in Bajaj Finance Ltd., a listed non-bank with the strategy and structure of a bank. It holds 74% stake each in Bajaj Allianz General Insurance Company Ltd. and Bajaj Allianz Life Insurance Company Ltd. Subsidiaries of Bajaj Finance Ltd. include Bajaj Housing Finance Ltd., offering a range of housing finance solu-tions, and Bajaj Financial Securities Ltd, an all-in-one digital platform combining demat, broking and margin trade financing for retail and HNI clients on a predominantly B2C platform. Bajaj Finserv holds an 80.13% stake in Bajaj Finserv Direct Limited, a diversified financial services and e-commerce open architecture marketplace for loans, cards, insurance, investments, payments and lifestyle products. Bajaj Finserv’s wholly owned subsidiaries include Bajaj Finserv Health Ltd., Bajaj Finserv Ventures Ltd., Bajaj Finserv Asset Management Ltd., and Bajaj Finserv Mutual Fund Trustee Ltd. Both BFS and BFL are included in the benchmark BSE Sensex and Nifty 50 index of large cap stocks. Bajaj Finserv is committed to driving equitable and inclusive opportunities for children and youth through its social impact initiatives. Its social responsibility pro-grammes in the areas of skilling, health, education, protection, skilling and inclusion for people with disability (PwD) are life-transformative and aimed at solving the most pressing issues of society. So far, Bajaj Finserv and its group of companies have touched over 2 million lives through 200+ partner-implemented programmes across the country. The company runs its flagship employability programme, CPBFI- Certificate Programme in Banking Finance and Insurance, aimed at making graduates from small towns employable in financial services industry.